Uncertainty

David R. Kotok, July 21, 2024

(The following was first published on Cumberland Advisors’ website and via LISTSERV. For details, visit https://www.cumber.com/.)

Mr. Market had answered this way about recent uncertainty: “Gimme bad news or gimme good news, but don’t gimme no news.”

It took an assassination attempt and the subsequent political events to initiate a “sea change” in financial markets. The dialogue was that the Biden-Trump contest was too close to call. That has changed to a polling estimate of a 2/3 likelihood that Trump wins against Biden and a better than 50-50 chance that MAGA will dominate the Republican Party. Here’s some excellent research from Politico, including a polling summary and a “battleground test” exploring different options for the Democratic nominee: “BATTLEGROUND TEST OF CANDIDATES, JULY 2024,” https://www.politico.com/f/?id=00000190-be78-dd41-afb9-fefc35f00000. And here’s a new Bloomberg interview with Donald Trump: “Trump on Taxes, Tariffs, Jerome Powell and More,” https://www.bloomberg.com/features/2024-trump-interview/

Markets reacted violently. In some sectors there was a virtual “melt-up.” In other sectors, market agents went from uncertainty to probabilities, and therefore prices changed dramatically. The climate trade weakened on a relative basis as both Trump and Vance have a history of anti-climate positions (“Drill, baby, drill”), while Biden has a history of climate change mitigation efforts. The corporate tax rate trade strengthened as markets priced in a likelihood that Trump would make the corporate tax cuts permanent. Inflation-prone sectors now expect more inflation from Trump. And deficits at the federal level are priced in for more debt and higher interest rates in the intermediate and longer term. Trump’s Republican platform doesn’t mention debt and deficits and the strident anti-debt Republicans have become silent.

Note that the shorter term is more likely to see lower short-term rates sooner because of the increasingly favorable outlook for the Fed to cut the short-term policy rate. But longer rates march to a different drummer, so the outlook changed in the direction of the yield curve steepening.

The recent cyber shock is worldwide and is an example of risk surfacing from a surprise and replacing uncertainty at a huge level. Before the cyber breakdown shock, we didn’t know and only guessed about it. Now we know and can begin to estimate costs and insurance changes and determine needed actions needed. Redundant systems are coming soon as a means for defense. Uncertainty becomes risk. Sometimes violently. Lesson for investors: shifts between uncertainty (we don’t know and cannot estimate probabilities) and risk (we estimate probabilities) can be volatile and violent in financial markets. Why? The cost-benefit equation lurches in a new direction.

The issue of uncertainty is a tough one to estimate, but there are some surveys that try to do it. Remember that uncertainty is defined differently than risk. Risk can be estimated with probabilities, as we now see in the market reaction to the Trump political outlook. They may be right or wrong, but there is some thread to that madness of assigning probabilities. Note that a possible Biden exit introduces a new insertion of uncertainty. Note that half the country didn’t want the contest between the two old men. If one drops out voluntarily, then that Trump versus Biden contest changes and there is only one of the old men remaining. We will find out.

Uncertainty, on the other hand, is not easily measured or even estimated; it is just there. It is the “I don’t know.” And it has profound impacts on business and economics, even when we cannot numerically determine its various effects.

Here’s some help from the National Federation of Independent Businesses (NFIB). The NFIB is directed at the small, and not-so-small, independent businesses in the United States. NFIB collects a lot of data and has been doing so for decades. I like to think of the NFIB survey data as the window into the half of the US economy that isn’t publicly owned and doesn’t trade on a stock exchange. That is about half of the nation’s economic engine, too. Some argue it is more than half. It’s the arena where lots of early-stage innovation and idea development occurs.

Here’s an NFIB missive on the uncertainty issue. I personally thank Bill Dunkelberg and Holly Wade of NFIB for their help in getting this information to us so we may share it with readers.

UNCERTAINTY CLOUDS THE FUTURE

When the path forward is not clear, it’s harder to decide on a direction and a strategy. That’s the situation small business owners see developing; it’s getting harder to confidently make a decision. NFIB’s Optimism Index is based on six questions (included in the Index of Small Business Optimism) that ask owners to peer into the future they see to guide spending, hiring, and pricing decisions. Questions like “do you plan to increase or decrease employment at your firm” have two obvious responses (increase or decrease) but also responses such as “don’t know”, “not sure”, “uncertain”, etc. The questions included in the Uncertainty Index are:

1. Expected Business Conditions in 6 Months

2. Is Current Period a Good Time to Expand

3. Expected Easier or Harder Credit Conditions

4. Expected Real Sales Direction

5. Expected Size of Workforce

6. Capital Spending Plans

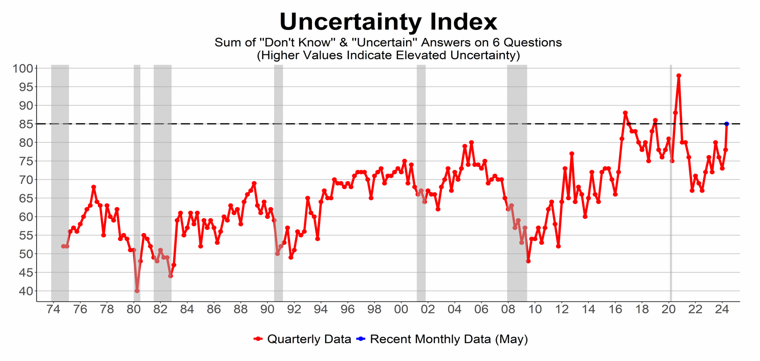

The Uncertainty Index is based on the total number of “uncertain” responses to the questions. Each respondent can give up to 6 uncertain responses, one for each of the six questions. The Index surged to a then-record high in 2016, faded somewhat and then established its 50-year high in 2021. From there, the Index fell dramatically to “normal” levels in 2022 before surging to the fourth highest reading ever in May (following the same path observed in 2016?). In recessions, uncertainty is low because most people are certain that the near-term economy will be bad. Uncertainty can be high in periods where there is uncertainty about economic policy (elections) or potential adverse economic developments (including global distress). Clearly, Covid was a major producer of uncertainty. Now, a presidential election, which promises major changes in economic policy, is driving uncertainty.

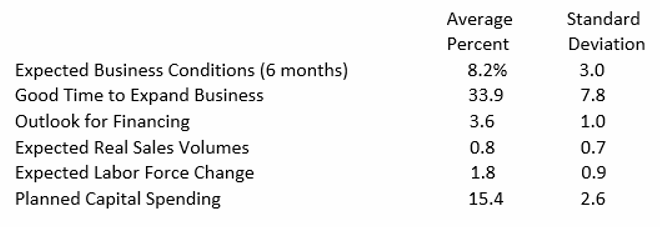

The components show a significant amount of variation. Table 1 shows the average percent with uncertain responses and a measure of the size of typical changes (the standard deviation) for each component. The “big movers” over the period were Expected Business Conditions and Good Time to Expand (largest standard deviations). Relative to the average percent who were uncertain, the largest movers (standard deviation relative to average) were Expected Real Sales and Expected Labor Force Change.

Table 1: Average Percent Uncertain About Direction. NFIB Small Business Economic Trends (standard deviation from average, 1986-2024).

Uncertainty is the enemy of economic growth and prosperity. Progress depends on the willingness of people to take risks, invest, and spend money. When decision-makers are uncertain, they are less willing to bet on the future. This impacts hiring, investment, innovation, and progress. For progress, we depend on the private sector to create jobs, wealth, and new ideas and it is heavily impacted by government policies, social order, and stability, all major sources of uncertainty. As some of these issues are addressed, uncertainty will exert less negative pressure on the economy and small firm decision-making and improve the investment environment.

Bill adds this, from NFIB’s “Problems and Priorities” study, conducted every 4 years:

“Uncertainty over Economic Conditions” and “Uncertainty over Government Actions” both moved up in importance from 2020. Small business owners rank “Uncertainty over Economic Conditions” as the third most severe problem facing their business, up from its ranking of 9th in 2020. Twenty-two percent of small business owners report it as critical. “Uncertainty over Government Actions” ranks 8th and is critical for 23 percent. Many thanks to Bill Dunkelberg and Holly Wade for the tutorial on uncertainty. Readers may wish to remember that rapid changes can occur in all directions. The political contest isn’t decided, although the outlook probabilities have been altered by a dramatic assassination attempt. We’re not yet to November.

A final note. Innocent bystanders were injured and one killed during the Trump assassination attempt. Corey Comperatore and his family are victims of murder. We are ending with a link in case some readers would like to know more about Corey and his memorial service. The two seriously wounded, David Dutch and James Copenhaver, continue to recover. https://www.ems1.com/firefighters/hundreds-gather-at-funeral-for-pa-fire-chief-killed-at-trump-rally