Trump Verdict & Markets

David R. Kotok, June 3, 2024

(The following was first published on Cumberland Advisors’ website and via LISTSERV. For details, visit https://www.cumber.com/.)

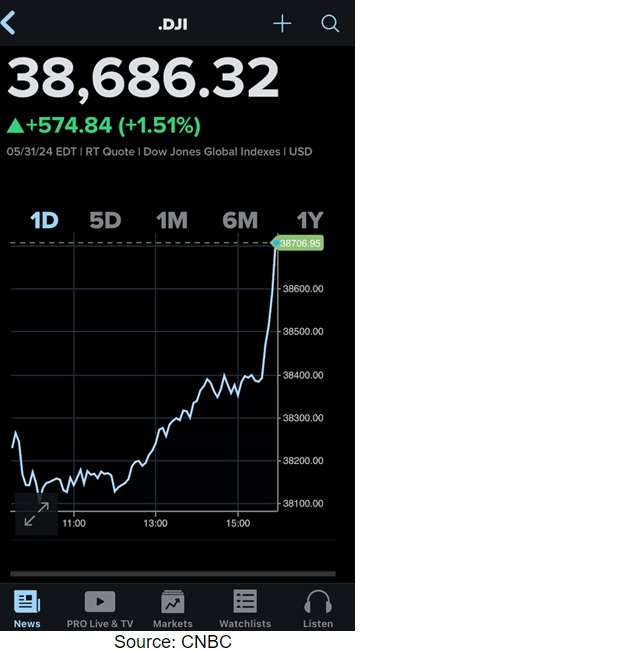

I received an email from a retired NY judge, who noted the 574-point rally in the Dow Jones Industrials as a positive response to Trump’s guilty verdict. I disagreed.

I believe markets rallied post-verdict for other reasons. Markets are still not discounting an outcome of the Biden-Trump contest, and this verdict didn’t change that by very much. It may change after the July 11 sentencing. Following this commentary there is a short reference list of Trump verdict-related forecasts.

Here is why I think the market reaction was driven by other forces.

Let’s look at a chart of Dow on the day after the verdict. Remember, the verdict was announced after the market closed on Thursday.

There was little change in futures prices in Asia the night after the verdict. Friday morning, trading in NY started with some gradual firming. Note the final half-hour trading surge. So, my friend who saw the full-day move may have misinterpreted Mr. Market when he wrote “Dow Up Over 500 Because of Guilty Verdict.”

Readers may also note that credit spreads have narrowed slightly since the verdict and CDS (US Government debt Credit Default Swap) pricing has been stable since the verdict.

So, what was the market-moving news?

At the end of last week, inflation data came in a little better than expectations and consumer spending unexpectedly fell slightly in April which the market interpreted the Federal Reserve will be less likely to hike rates and more inclined to cut rates at the end of this year. While Fed Futures currently show the market pricing a ~50% probability of a September rate cut, David Berson (Cumberland Advisors Chief US Economist) believes it unlikely that the Fed will ease in the near term unless upcoming data shows a dive in economic growth and/or continued, meaningful decreases in inflation. Market expectations for a September cut are currently too high based on currently reported data. Our base case is for December or Q1 for the first cut, but as always one must remain data dependent.

Let me bring in some help on this question of Fed policy.

Kathleen Hays interviewed Tom Hoenig on her podcast. He took about 15 minutes to offer a very insightful view of current Fed policy. Kathleen is a skilled interviewer and very seasoned journalist. Disclosure: I worked with her when she was at CNBC and during her time at Bloomberg, so we have a long history. I recommend listening to the full interview with Tom Hoenig, whose credentials are impeccable. Not mentioned is that he is also a Fellow in the Global Interdependence Center’s College of Central Bankers. See: www.interdependence.org. Readers may find Kathleen’s podcast about central banking helpful. Clearly, I do.

Here’s the link to the podcast. It helps explain current Fed policy and what was behind the market move, IMO. “Hoenig: Fed Faces ‘Fragile Equilibrium’ as Inflation Steadies Near 3%” Readers may freely take any specific questions about the stock market to Matt McAleer. Take any specific questions about the bond market to John Mousseau.

And for readers’ convenience, here’s an edited transcript of the interview.

Hoenig: Fed Faces “Fragile Steady State” as Inflation Steadies Near 3%

Kathleen Hays Presents: Central Bank Central Podcast

KATHLEEN HAYS:

Welcome to Central Bank Central. I’m Kathleen Hayes. Well, a big day for information that is going to lead to the Fed’s decision, potentially, certainly when it signals that it’s meeting a week and a half from now, the Fed’s favorite inflation gauge. That’s the PCE deflator released today. Some see a little bit of improvement, some signs that maybe inflation is just not, at least not getting higher in the latest month. Of course, this is a very important question. This is the month of April, data we’re looking at today, and others saying <it> looks like we’re not seeing a lot of progress, certainly not the kind the Fed has signaled it wants to see to be able to move, finally, to cut interest rates. So bringing in someone who has been there, done that himself. And I’m speaking of Thomas Hoenig, former president of the Federal Reserve Bank of Kansas City, former vice chair of the FDIC, and now a distinguished senior fellow at the Mercatus Center. So Tom, welcome back to Central Bank Central.

0:58

THOMAS HOENIG:

Thank you. Good to be back. And thanks for having me.

1:00

KATHLEEN HAYS:

Well, uh, you know, this is what it’s all about, isn’t it? Inflation. Jay Powell, the Fed chair, has said he needs to see several more months of favorable inflation data to be ready to look at this question of cutting rates. So how would you sum it up? You know, in a nutshell, what do we see in the PCE headline, the core which takes out food, energy? What’s the message?

1:25

THOMAS HOENIG:

The message is we’re mostly in a steady state of around 3% inflation, uh, one-tenth percent maybe improvement in one place or another. But overall, if you look at almost the last year, we’ve been really running at around 3% total and mostly core inflation rate of around 3%. And I think that is expected to continue given we’re in this, what I call, modest steady state. Different ways to explain it. The way I explain it to people is that inside the FOMC right now, there appears to be a lot of discussion around the so-called neutral rate or R-star, as they like to refer to it, and where that is. And early on, it was argued it was less than half a percent, but more and more people are saying, wait a minute, that’s a naturally low, given all the fiscal stimulus that we put into the economy, the demand for investment goods and so forth, or I should say for credit, perhaps the so-called R-star or neutral rate is closer to 2%. And if that’s the case, Kathleen, with the interest rate, the Fed funds rate at 5.3 and inflation at 3%, that means your real interest rate is around 2, 2-and-a-quarter percent – mostly in line then with this perhaps neutral rate of R-star of 2%. If that’s the case, then you are in a steady state, maybe a very fragile steady state, but a steady state of around 3% inflation.

3:13

KATHLEEN HAYS:

Okay. And of course, these numbers from the PCE on the headline and the core, they’re like 2.7 and 2.8 year over year. The CPI year-over-year numbers are a bit higher. And I know you prefer the consumer price index over the Fed’s official gauge because the consumer price index reflects the prices we’re actually paying at the store.

3:36

THOMAS HOENIG:

Well, not only that, but all our indexes are tied to the CPI. Most people look at the CPI. They don’t know what the PCE is. So that’s what’s really influencing people. And I think that’s why you want to use that as a measure, because that’s going to influence how they think about inflation forward and how they’re living with inflation today.

3:57

KATHLEEN HAYS:

And let’s come back to the R-star, uh, the neutral rate. The neutral rate is the rate where it doesn’t stimulate the economy, right? It doesn’t slow down the economy. So the point would be, I think your argument is that we may be at a point where the funds rate, five-and-a-quarter-ish, between five-and- a-quarter and five-and-a-half, the Fed’s key rate at this point doesn’t need to go down. In fact, it’s restrictive enough just to maintain this steady state you’re referring to.

4:30

THOMAS HOENIG:

The 3% inflation rate. And the disappointing part of that is it would suggest that if you want to bring inflation down more quickly, you have to raise rates. And no one wants to raise rates. Certainly, I don’t know very many people on the FOMC who want to raise rates, and I don’t think many people in the markets want to see rates higher. So what they’re doing is saying, in effect, we are in the neighborhood of the steady state. We’re perhaps very modestly tight, and so we’re willing to wait over a long period of time to have inflation come down because we don’t really want to shake things up to break it down more quickly. That’s kind of the message I get from their current stance on policy.

5:14

KATHLEEN HAYS:

Well, they say higher for longer, several more months, as I mentioned just now, of favorable inflation data. But I guess that’s the question, isn’t it? What’s favorable enough? If R-star is higher, and this is a big debate right now, if we’re at 3%, around 3%, when you look at the gauges, then the Fed’s saying we’re willing to wait and just assume there are other forces that are going to bring down inflation. Like what, a slowdown in the economy? Is that kind of the message we’re getting?

5:49

THOMAS HOENIG:

I think so. I think they’re looking to see.. What they’re saying is we’re going to be very patient in one sense, that we’re going to take our time to have it come down more slowly. And where rates are now will allow that to happen. I think that’s number one. Number two, they are looking for the economy to slow. And, you know, the GDP numbers that came out, the revised numbers were weaker than the last preliminary numbers. So they are seeing that. So let’s wait and see. The economy is what I call in a fragile equilibrium right now. And unless something shocks it, we’re going to wait and allow inflation to come down very slowly so long as it doesn’t increase, we’ll wait and see without raising rates and without lowering rates.

6:37

KATHLEEN HAYS:

Is the Fed on the right track? Is there a problem with that?

6:40

THOMAS HOENIG:

I think given the trade-offs, they’re probably on the right track if, in fact, it is modestly tight. And that’s a question that time will tell. But at least right now, it looks like they’re in a, I keep saying a very fragile equilibrium that would bring it down over a long period of time. And they’re willing to live with that. And I think the economy is willing to live with that as well. Now, labor, you saw the employment cost index coming up. They’re still trying to regain some of their purchasing power, their real increases in their incomes. They’re going to continue to put that pressure on. And that’s where you see this 3% as the steady state.

7:25

KATHLEEN HAYS:

So I want to touch, you’re making me think of this Cleveland Fed study that was released from their Inflation Research Center just yesterday. And I would recommend everybody to go to the Cleveland Fed website and read it. And even if you just read the summary, the summary is saying that there are intrinsic and extrinsic factors, X factors that drive inflation, and that the extrinsic factors are the supply side constraints that when supply sides eased up, boy, inflation came down for several months last year. Intrinsic, though, has to do with inflation expectations with wages and what they’re doing. And by that gauge, they say that inflation, their research suggests by the second quarter of next year, inflation on their trimmed mean measure will be 2.7%. And it won’t be anywhere near 2% really until 2027. This, I guess this is going to show potentially that if the Fed maintains this stance, maybe, maybe they just will.. Will they give up the rate cuts for a while do you think? Is that going to be off the table?

THOMAS HOENIG:

Well, I think that’s a real possibility. If Cleveland’s right and if what I’ve just described with the neutral rate is in the ballpark correct, then yes, then it’s just a matter of wait and see. And, uh, I’m not a student of their model, but I think I agree with them. I mean, there are supply factors. Those have worked through or passed the pandemic. Supply chains are reestablishing themselves, but we still have a huge demand factor out there. And that is a very strong fiscal stimulus that continues to have influence on the economy. That’s still working its way through. For example, we have the debt that is growing by leaps and bounds every month. That is still in place. So that keeps upward pressure on interest rates and where they should be. And so we’re in this moment of wait and see, around a 3% inflation run, and supply and demand slowly coming into balance over the long run. But it’s going to take a while because if we’re tight, if the Fed’s tight, it’s modestly tight given the current circumstances. Now, the question is, what would cause the Fed to lower rates sooner? And that’s, I think, tied to the fact that, should the economy slow dramatically, or should we have a banking mini-crisis or crisis, then they would provide liquidity and they would lower rates more quickly than otherwise. And that’s really unknown that we’re all kind of holding our breath about, especially as you look at the trends in banking and the growth of the GDP numbers quarter to quarter.

10:20

KATHLEEN HAYS:

Okay, before I get to that, because I’m glad you brought up the banking issue, again, you were vice chair of the FDIC, and it’s one of the major issues that you are addressing now in your work at the Mercatus Center. But I do want to ask you because basically, I think you’re saying the Fed’s in hold mode, higher for longer, whatever you want to call it. Dots, though, I have to ask you this. Two weeks ago, I had the privilege of interviewing Loretta Mester, president of Cleveland Fed. And one of the things I asked her about, which of course, as you will expect, I didn’t get an answer, was dots. Because the previous dots, December and March, and that’s the Fed’s forecast. They look at unemployment and what they think inflation’s doing and GDP. And then they have, they attach.. So based upon what I see there, each one has a forecast for what the rate moves will be over the rest of the year. And she said, basically, well, we’re going to watch the numbers. You just have to watch the numbers and see what you get there. Of course, she didn’t give me her sense of what the dots are going to be from her. What do you think? If you were there, what would your dots be? Would you just be sort of saying, like, nothing is going to happen this year? What kind of dot forecast would you have?

11:39

THOMAS HOENIG:

That’s a great question. No one really understands what the dot plots mean. Do they mean, here’s what I think will happen? Do they mean, here’s what I think should happen? It’s unclear. And I think among the members, they all have different kind of opinions. That’s why I’m not a real fan of the dot plots. But the fact of the matter is, I think going forward, they are really forecasting very modest declines in inflation over time. And their dot plots this time will show more of that. And so they will be thinking, as we’ve just been talking, inflation around 3%. No one’s going to forecast a recession, although that’s a risk that we have. But those who are more concerned about growth will show a slower growth going forward and therefore justification for lower interest rates. Those who are more concerned about inflation will be at the other, kind of the upside of that. And we’ll look at those plots and that gives you a range of how the discussions inside the FOMC are going. And that’s the best you can use those things for because they’re really guessing. When I was involved, I wasn’t really involved in dot plots, but we used to do the forecast and you really didn’t know because, why? Well, number one, I don’t know what’s going to happen to international trade. Is it going to get better or worse? I don’t know what is going to happen in terms of the conflict around the world. I don’t know what’s going to happen with labor demand and whether they’re going to continue. Is the economy going to stay growing around 2% or not? Those are all questions that we can’t say for sure. But where monetary policy comes in is to say, we’re going to look at our current policy. We don’t want to cause a crisis. But we don’t want inflation to pick up. So we’re going to stay where we are until we have a clear sense of which direction things are going. And what would define that? If we have more quarters of slowing GDP growth, number one. And if we have more bank problems in the future, then we’re going to change our mind.

13:51

KATHLEEN HAYS:

There’s definitely some people who think they’re wrong not to hike rates.

13:55

THOMAS HOENIG:

Well, I would agree they’re not going to get inflation down very quickly if they don’t raise rates. But I will say if they raise rates now after they’ve set this thing up the way they have, it would be very disruptive. They’re going to have to take their time to reorient the public and the markets to the fact that interest rate increases are not off the table. They took those off the table prematurely, starting as early as last September, and then confirmed it in November, December, and now they’re stuck with it. So they have to start almost from scratch to rebuild that, otherwise they’re going to have a real shock in the economy.

14:34

KATHLEEN HAYS:

Tom, thanks so much. Covered a lot of ground today. Certainly, the latest inflation numbers may not be game-changing, but maybe they’re something that’s going to underscore what you said and what has been signaled from the Fed. Not ready to cut rates, but certainly the messaging we hear at the Fed’s meeting week after next is going to be very important. Also, though, I want to get you back soon to talk more about the banking system – this question of financial stability – and how that may be increasingly affecting policy decision at the Fed at the coming meeting and in the future.

15:05

THOMAS HOENIG:

I’m happy to come back. I think that’s a huge issue that people are not paying too much attention to because they think it’s behind, given last year’s events and their past. But still, there’s a lot of fragility within the banking system. And I think the FOMC is aware of that and it needs more discussion. So I’m happy to come back and talk with you.

15:26

KATHLEEN HAYS:

Well, I’m very glad to hear that. And of course, for everybody, again, this is Thomas Hoenig. He’s a former president of the Federal Reserve Bank of Kansas City. And importantly, when we talk about banks, he was vice chair at the FDIC, the Federal Deposit Insurance Corporation. And of course, if you want to learn more about what he has written, what he thinks about the banking system, he is a distinguished senior fellow at the Mercatus Center. And you can find him there.

I’m Kathleen Hayes. This is Central Bank Central.

__________

Now, here’s the partial list of Trump verdict-related forecasts.

“Fox Predicts Stock Market Crash After Conviction,” https://www.msn.com/en-us/money/markets/fox-predicts-stock-market-crash-after-conviction/vi-BB1nq93y

“Wall Street Scans for Potential Volatility After Trump Verdict,” https://www.bloomberg.com/news/articles/2024-05-30/wall-street-girds-for-potential-volatility-after-trump-verdict

“Trump found guilty: Stock markets slide, read investor reaction,” https://www.reuters.com/legal/view-jury-finds-trump-guilty-all-counts-hush-money-trial-2024-05-30/

“Dow Has Best Day of Year After MAGA Predicts Trump Conviction Crash,” https://meidasnews.com/news/dow-has-best-day-of-year-after-maga-predicts-trump-conviction-crash

One response to “Trump Verdict & Markets, by David R. Kotok, June 3, 2024”

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.