Friday’s Jobs Report & Climate Change

David R. Kotok, August 7, 2024

(The following was first published on Cumberland Advisors’ website and via LISTSERV. For details, visit https://www.cumber.com/.)

My sharp-eyed friend Bob Brusca of FAO Economics (https://factandopinioneconomics.com/) caught a possible information “nugget” in the BLS’s data and the Friday, August 2 employment report. He noted that very few media folks reported it.Â

Here’s Bob’s “catch”:Â

The BLS said Hurricane Beryl, which slammed Texas during the survey week of the July employment report, had “no discernible effect” on the data.

Â

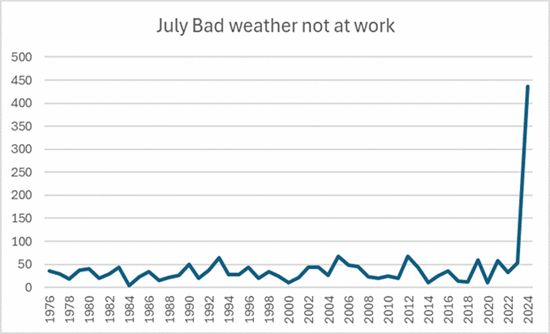

The household survey, however, showed 436,000 people reported that they could not report to work because of bad weather last month, the highest on record for July. There were 249,000 people on temporary layoff last month.

Â

The average workweek fell to 34.2 hours from 34.3 hours in June, also suggesting that Beryl had some impact on the labor market. But construction payrolls increased as did leisure and hospitality employment, which would weaken the weather argument.

Bob sent me his spreadsheet to support the evidence in the chart below. Here’s the data source:Â https://data.bls.gov/timeseries/LNU02033224&years_option=all_years.

Bob explains:Â

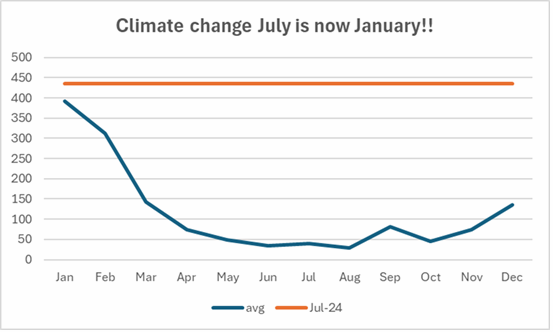

As you can see, July 2024 disruption is a higher-than-average reading even for January where the average job dislocation is … highest. In fact, if we rank the July 2024 figure among all January observations to 1977, it ranks as the 13th most-disrupted January among those 49 observations! This is not only “January,” it is a BAD “January.”

Kotok comment. Dear readers, it is July, not January. Â

Bob further notes that the BLS survey item non-Ag job holders unable to work in July because of the weather is 10 (TEN!) standard deviations above the mean for July. He adds, “Maybe BLS staff went to see Twister and thought tornadoes and hurricanes are simply normal?”

Philippa Dunne and Doug Henwood of TLR Analytics also caught the item. Here’s the reference in their Friday missive:Â

Although a box in the report says there was “no discernible effect” from Hurricane Beryl, an unusually large number of respondents reported not working at all or working shorter hours because of weather compared to your average July. This could just be a reflection of a broader effect of hotter summers, so those old averages may no longer apply. (TLRWire subscriber email, https://www.tlranalytics.com/)Â

I have been writing about economics and financial markets and asset pricing in relation to climate change. Understanding climate change is key to understanding the asset pricing related to it. At the same time, my home state of Florida has a state board of education that is removing climate change references from textbooks (“Textbook authors told climate change references must be cut to get Florida’s OK,” https://www.orlandosentinel.com/2024/07/05/textbook-authors-told-climate-change-references-must-be-cut-to-get-floridas-ok/). Â

Please ask yourself how this labor force and employment issue that I mention in this missive and that was reported by two prominent analysts, FAO Economics and TLR Analytics, is supposed to be taught in Florida’s business schools when those schools cannot talk about climate change.Â

Meanwhile, we thank Bob Brusca and Philippa Dunne and Doug Henwood and media like Reuters for reporting the story.Â

Climate change is real. Even in Florida! It impacts the labor force as you can see above. Only deniers avoid admitting it.