About David R. Kotok

David Kotok co-founded Cumberland Advisors in 1973 and during his career served as its Chief Investment Officer, CEO, and Board Chairman. David’s articles and financial market commentaries have appeared in the New York Times, the Wall Street Journal, Barron’s, and other publications. He is a contributor or source to Bloomberg, Yahoo, CNN, Reuters, USA Today, and other media. He holds a B.S. in economics from the Wharton School of the University of Pennsylvania, an M.S. in organizational dynamics from the School of Arts and Sciences at the University of Pennsylvania, and an M.A. in philosophy from the University of Pennsylvania.

David has authored or co-authored five books, including The Fed and the Flu: Parsing Pandemic Economic Shocks (February 2025, www.thefedandtheflu.com), From Bear to Bull with ETFs (now in its second edition), and Adventures in Muniland. His latest book, The Fed and the Flu, examines how pandemic economic shocks have played out across history and how the Federal Reserve responded to the COVID-19 pandemic shock.

He has also written three monograph pamphlets. The first of these is “Lessons from Thucydides,” which details information asymmetries and their implications for investors and world affairs. The second is “Zika,” a work that compiles David’s research, interviews, and personal experience concerning the Zika virus and its potential for serious damage in the way of health and monetary costs. The expense for individuals can be devastating; and in the case of governments, ballooning health budgets may affect municipal bond ratings. The third is “Yield Curve Control – The story of ZIRP and NIRP.” The yield curve is usually defined as the range of yields on Treasury securities from three-month Treasury bills to 30-year Treasury bonds. David’s narrative and graphics tell the story of ZIRP (zero interest rate policy) and NIRP (negative interest rate policy) and explore what happens when central banks use YCC to control interest rates along some portion of the yield curve.

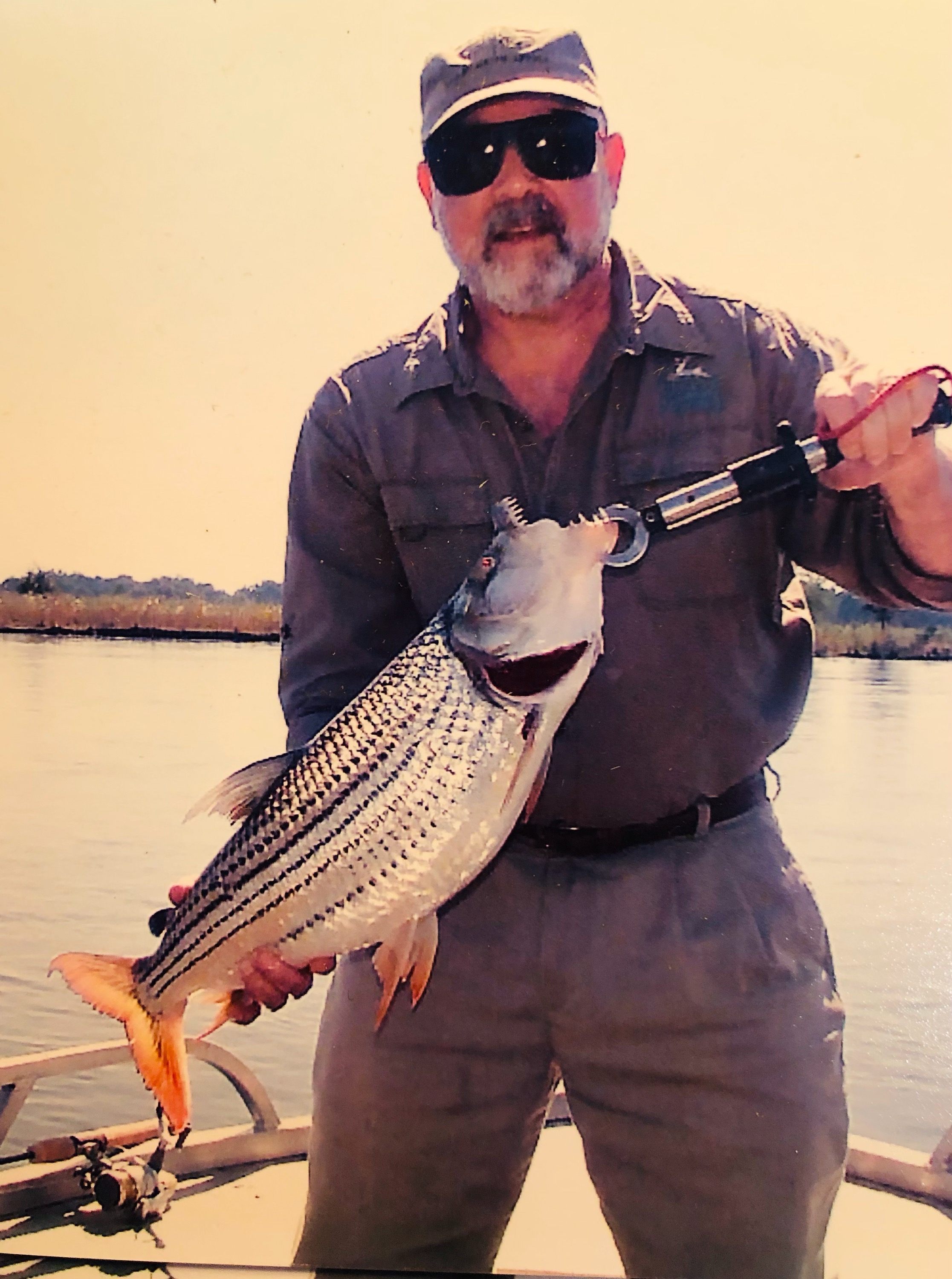

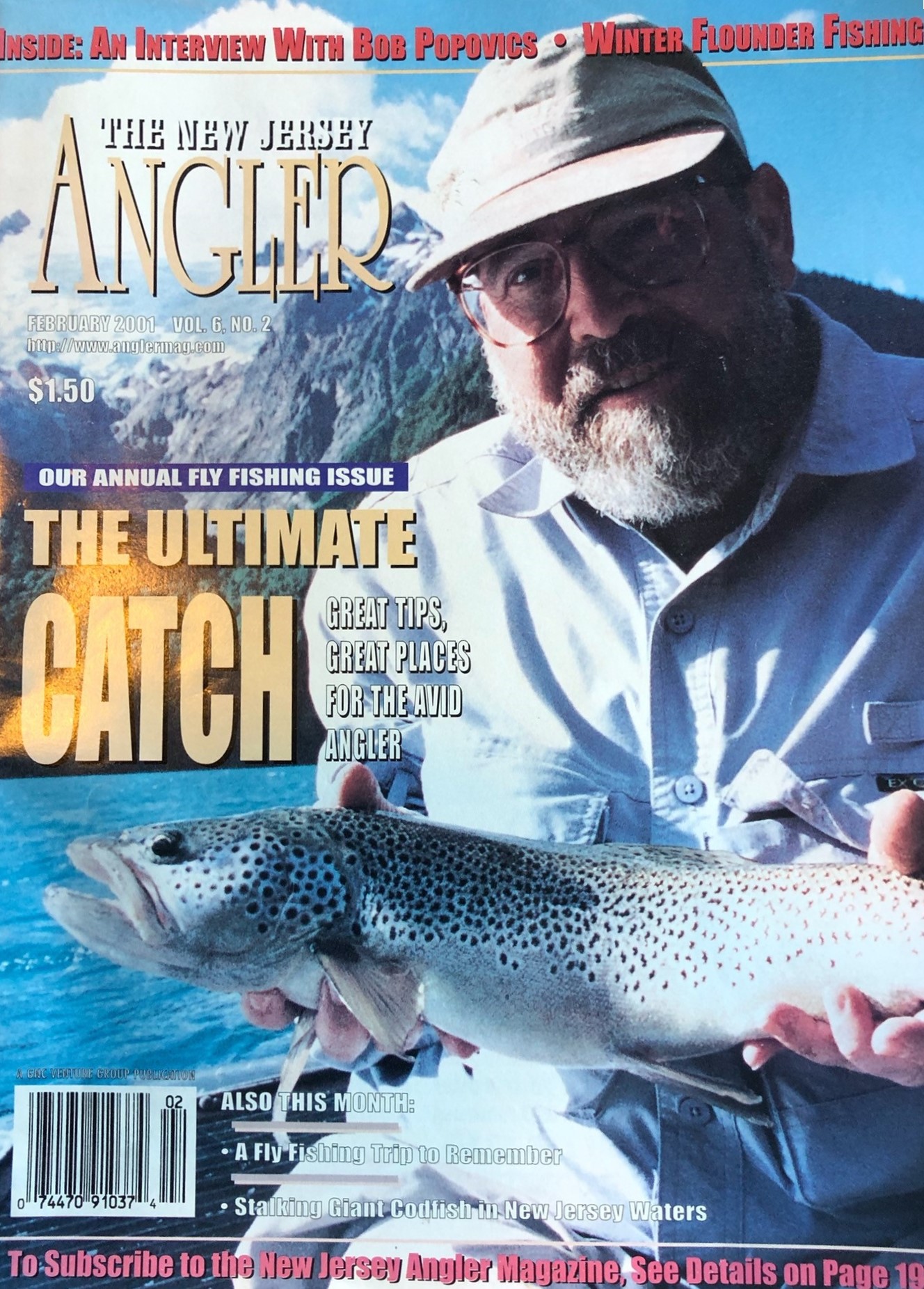

David has served as Program Chairman and as a Director of the Global Interdependence Center (GIC), www.interdependence.org/, whose mission is to encourage the expansion of global dialogue and free trade in order to improve cooperation and understanding among nation states, with the goal of reducing international conflicts and improving worldwide living standards. David chaired its Central Banking Series and organized a five-continent dialogue held in Cape Town, Hong Kong, Hanoi, Milan, Paris, Philadelphia, Prague, Rome, Santiago, Singapore, Tallinn, and Zambia (Livingstone). He has received the Global Citizen Award from GIC for his efforts. In conjunction with GIC, David organizes fishing retreats, primarily in Maine, that are affectionately known as “Camp Kotok” by friends and many in the financial press. More about those retreats can be found on the Camp Kotok page of this website and at www.cumber.com/about/camp-kotok.

David has also been an avid supporter of and advocate for the work of Florida’s Climate Adaptation Center since its creation. In recognition of his efforts, the CAC honored him as a 2025 Climate Champion.

Early Life

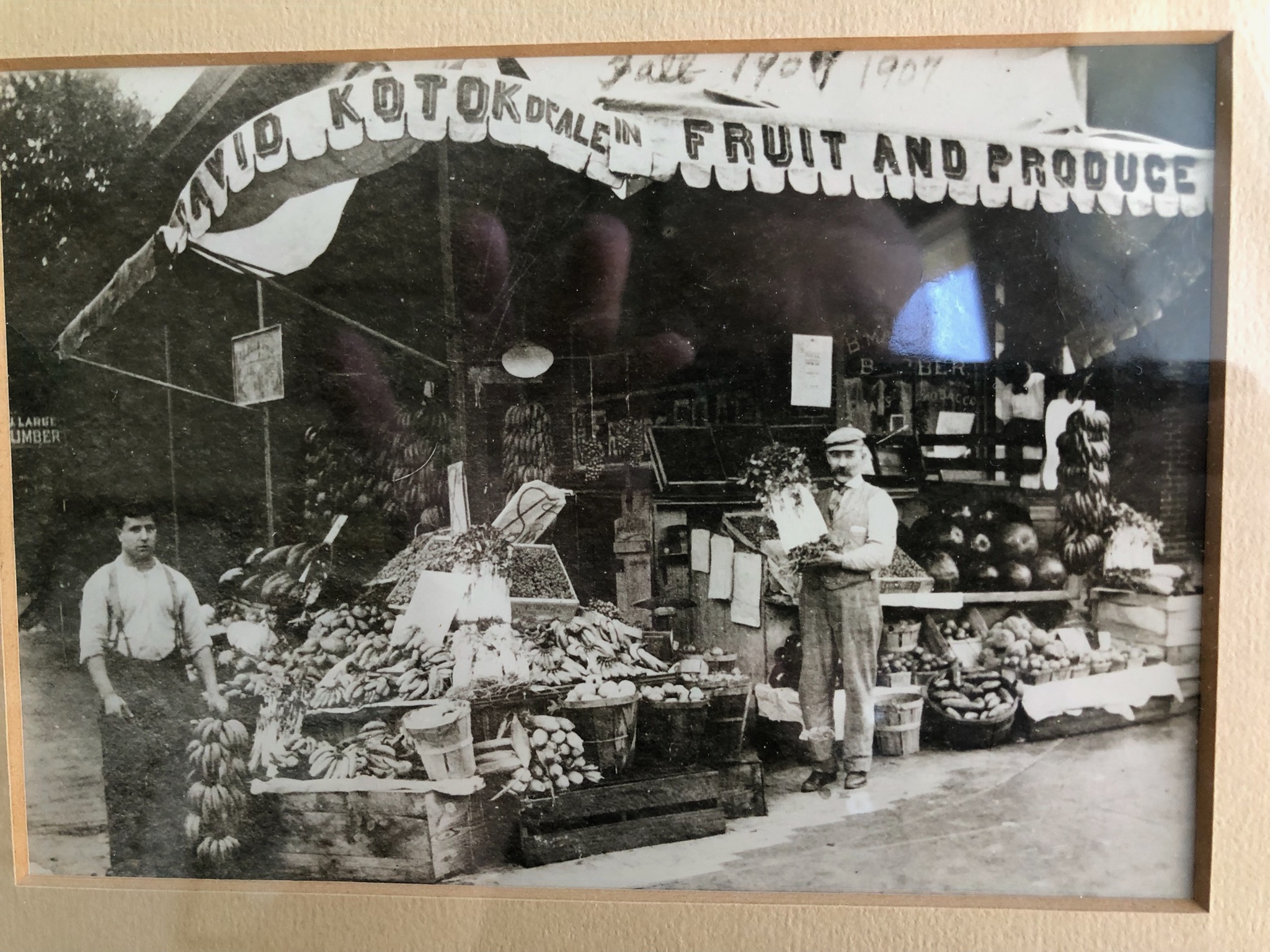

David Raphael Kotok was born in Vineland, New Jersey on March 3, 1943 to Leslie and Sheva (Crystal) Kotok. Kotok worked at the family businesses, one being Kotok’s Market, the Kotok family grocery store founded by his great-grandfather, David Kotok, for whom he was named. His jobs there included sorting vegetables, waiting on customers, and accompanying his father to food and produce auctions. He also tended chores on his maternal grandparents’ family farm (and even milked a cow at the age of 6 while avoiding being kicked by the cow).

Kotok’s father taught him to fish at age 5, sparking his lifelong passion for the sport.

Early Investing

When David Kotok was 10 years old, his grandfather, Myer Kotok, took him along to the local stockbroker for the first of what became many times. In those days, the tape was paper; it was read out and a person wrote prices on a chalkboard. David Kotok’s early experience included writing quotes on the board. His grandfather opened a small brokerage account in his own name, but the younger Kotok traded it, using money he had earned working at the family grocery store.

Education

Kotok holds a B.S. in economics from the Wharton School of the University of Pennsylvania, an M.S. in organizational dynamics from the School of Arts and Sciences at the University of Pennsylvania, and an M.A. in philosophy from the University of Pennsylvania.

Military Service

Kotok joined the United States Army after receiving his undergraduate degree. He served from 1966 to 1969, achieving the rank of Captain before his honorable discharge.

September 11, 2001

David Kotok was attending the Annual Conference of National Association for Business Economics (NABE), at a conference breakfast meeting on the ground floor of the Marriott Hotel, which is next to the South Tower of the World Trade Center, on September 11, 2001 when the first explosion occurred in the North Tower. Not knowing what happened, the group quickly filed out of the building. That’s when they saw the pandemonium. Within a short time, the second plane hit.

Kotok has reflected, written, and spoken publicly, articulating the impact of his experiences that day. A few of those writings can be found at the following:

Contact Us

Join our free email list to:

- Receive all of our posts by email, or

- Receive weekly updates with links to the latest posts on our website, or

- Join the media/press/journalist list.

DISCLAIMER: The content on this website is provided for informational purposes only and should not be relied upon in any manner as professional advice or an endorsement of any practices, products, or services. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of David R. Kotok and should not be regarded as the views of Cumberland Advisors, Inc. or its employees or management, as a description of any investment advisory services provided by Cumberland Advisors, Inc. References to any securities or digital assets or performance data are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Any charts and/or graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. David R. Kotok is currently an independent contractor and not an employee of Cumberland Advisors, Inc. He may independently receive payments from various entities for consulting, advisory and board functions, speaking fees, book royalties, advertisements in affiliated podcasts, blogs, and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation thereof, or any affiliation therewith, by the Content Creator, by David R. Kotok, or by Cumberland Advisors, Inc., or any of its employees. For additional disclaimers and disclosures see Cumberland Advisors’ website: https://www.cumber.com/.

© David Kotok 2025 – All Rights Reserved