France

David R. Kotok, June 21, 2024

(The following was first published on Cumberland Advisors’ website and via LISTSERV. For details, visit https://www.cumber.com/.)

“How can you govern a country with two hundred thirty-eight varieties of cheese?” “• François Mitterrand, President of France, 1981–1995

Henry Kissinger to Chinese Premier Zhou Enlai in 1972: “What do you think of the French revolution?”

Zhou: “Too early to say.”

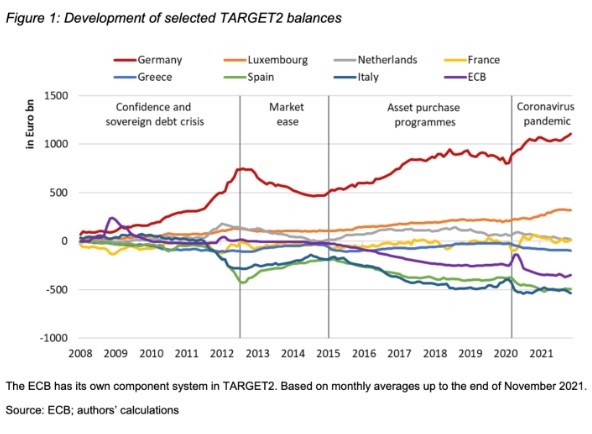

Political risk in the forthcoming French snap election is a developing issue. At the worst, a new government might attempt a French version of Brexit. The situation with regard to such an attempt is much different than in the UK case since France is part of the eurozone and the Brits were not. The French part of the euro monetary union is huge and second only to Germany in size. And the provisions for leaving include the requirement to settle and pay all liabilities. Essentially, the provisions are such that there is every incentive to remain in the eurozone once you’re in and every possible financial and monetary disincentive to try to leave. One need only examine the TARGET2 (T2) balances to see this monetary situation as it currently exists.

I see no way that France abandons the euro. It would be an act of madness in both political and economic terms. Sensationalist media and social media is just that: sensationalism at work.

Other risks include distortion and disruption of the European Central Bank (ECB) and other government-related economic activity. For perspective, France has a deficit-to-GDP ratio about the same as the US’s, according to my colleague David Berson, Cumberland’s Chief US Economist.

The difference between the US and France is that we finance ourselves in the US dollar, and it is the world’s largest reserve currency (about 60%), while France is financed in euros, the second largest reserve currency (about 20%); but decisions about the euro are made by the ECB, of which France is a voting member of the governing council but not the sole authority. There is risk of a new French government regime attempting a politically induced disruption of the ECB. We consider that to be a remote risk. We are familiar with this type of threatened political disruption in the US, but so far, in America, it has not affected the independence of the Federal Reserve as America’s central bank. IMO, a French election outcome that was disruptive wouldn’t stop the ECB from conducting policy debates and making decisions, but it would make some headlines and therefore risk being distortive.

What about commerce – commercial and industrial activity and contractual arrangements, and the related business issues? Here the risk may be higher if challenger Marine Le Pen prevails and forms a government. We can only speculate about that outcome right now.

But markets are already moving, as the risk is higher than it was before Macron called the snap election.

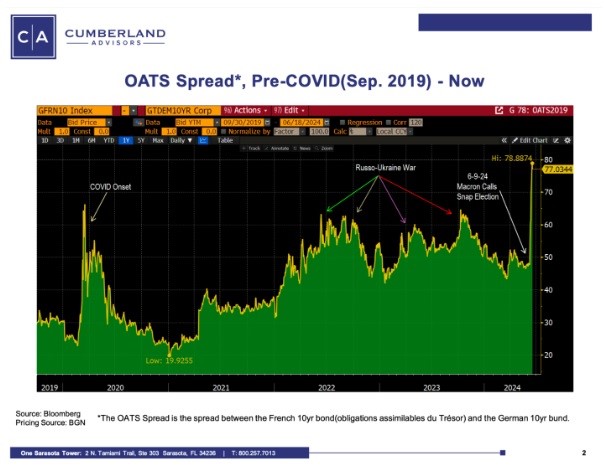

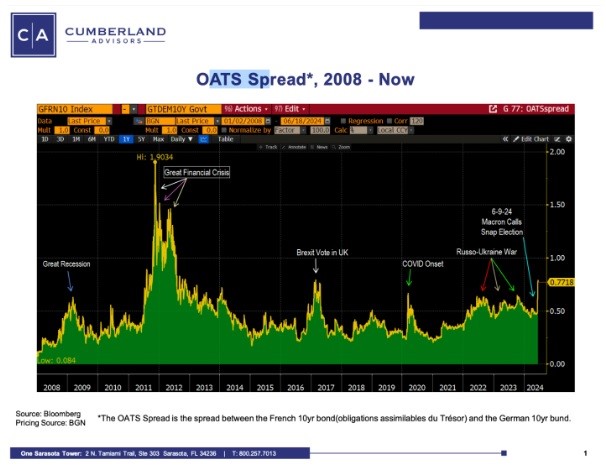

Here’s some visual assistance. We will show the OATS, the spread between the French debt and German debt benchmarks. The OATS spread is not one of those financial metrics you hear discussed very much. That’s good, because if people start talking about it, that’s almost certainly a bad omen. Like the plumbing in your house, you ignore it unless something goes wrong, and then nothing is more important.

Let me quote John Authers of Bloomberg:

“So, the bad news is that the OATS Spread (the gap between the yields of 10-year bonds issued by France, known as OATS for obligations assimilables du Trésor, and German bunds) is back at the center of discussion. It’s just surged in a remarkable way. After the market closed on May 31, OATS suffered a downgrade from the S&P Global rating agency. The market went sideways for a week after that, even after the European Central Bank announced a rate cut. But the spread ballooned after a political shock of the first magnitude. French President Emmanuel Macron announced snap legislative elections after sustaining a hammering from the far-right Rassemblement National in European elections, and by Tuesday even had to bat away rumors that he was resigning.”

Chart 1 shows the Macron spike and the period since the Covid shock. Note that spreads are based on market prices, and they are determined by real-money bettors and not by media opinions. They are wider since Macron’s move.

Chart 2 puts the period in context by showing the same spreads all the way back to the times preceding the Great Financial Crisis.

Lastly, we give readers a reading list to gain context on the current electoral shock in France.

(As for me, a glass of fine Bordeaux and a piece of a tasty French cheese are pleasures that have survived political turmoil in France for many decades. Lunch?)

Reading List

“How Emmanuel Macron lobbed a grenade at the hard-Right and blew up French politics,”

“France’s political scene in chaos,”

https://mailchi.mp/euractiv/the-brief-war-of-the-lingua-franca-501340?e=7ecb11a9b7

“French Finance Chief Warns Left-Wing Win Would Mean EU Exit,”

“City traders bet against French bonds as debt crisis looms,”

“What Exactly Do the Radical Right’s Wins Mean for the EU?”

Excerpt:

“We looked at fourteen parties in fourteen countries. Of these, six or seven of the parties actually have roots in either fascism or Nazism, neo-Nazism. You know, Rassemblement National [National Rally]–Marine Le Pen’s father was a collaborator with Nazis, right? The Sweden Democrats also have roots in neo-Nazism. Then we have the ethno-nationalist parties or nativist parties. But what brings them together really is that they are democratic, but they are illiberal. The extreme right is illiberal and antidemocratic.”

“Europe’s election campaigns are under the constant threat of foreign interference,”

“Why the European Union’s pandemic-related fiscal measures are curbing TARGET2 balances,”

“June 6, 1984 at Pointe du Hoc on Normandy beach in France,”

https://www.reaganfoundation.org/ronald-reagan/the-presidency/d-day/

“War and Peace: Ukraine’s Impossible Choices,”

https://carnegieendowment.org/research/2024/06/ukraine-public-opinion-russia-war?lang=en